Client Information

You can access the general information listed in the first section of Client Info page.

| Field | Description |

|---|---|

| Client Name | The name of the client organization or its primary operational unit. |

| Tax ID | The tax identification number for the client organization. |

| Effective Date | The date on which the client organization takes effect in the

application. If changes are made to the client configuration, and this date is set in the future, then the changes do not become effective until that date. |

| Justification | Enter the justification for modifying the client information.

|

| Field | Description |

|---|---|

| Unit Name | The name of the operational unit (Op Unit) in the client

organization. For more information about operational units, see Operational Units. |

| Active | You can set the Op Unit to active or inactive by using the

Active check box. If you do not select this check box, the operational unit is not available when creating a request. |

| Field | Description |

|---|---|

| Country | You can add more than one country for a client. In addition to setting up countries for a client organization, it is required to define locations in the country for client. You can define additional settings for each country. For more information about client location settings, see Client Locations. |

| Active | At least one country must be set to Active in the configuration. Only countries that have been set to active are available when creating a request. |

| Field | Description |

|---|---|

| MSP Organization Note: This information is set to view only and

cannot be modified. |

The name of the managed service provider that is responsible for the client. |

| MSP Admins | The name of the administrator from the MSP organization. This

role has access to create/edit functions in the tool, and is the

point of contact. For more information about the MSP role, see MSP User Permissions. |

| Field | Description |

|---|---|

| Name | The name of the business to remit payments to. |

| Address Line 1 | The mailing address business title or address of the business to remit payments to. |

| Address Line 2 | Additional mailing address business title or address information. |

| Country | The corporate domicile country where the business is located. |

| State/Province | The state or province where the business is located. |

| City | The city where the business is located. |

| Postal Code | The postal code where the business is located. |

| Bank Name | The name of the bank where the remit business account is located. |

| Account Number | The account number of the remit business account. |

| Account Holder | The business name declared on the remit business account. |

| Routing Number | The routing number of the remit business account. |

| City | The city for the bank branch where the remit business account is located. |

| State/Province | The state or province for the bank branch where the remit business account is located. |

You can view or modify the corporate and billing address information in the Addresses section. The following table describes the fields for both the corporate and billing address inputs.

| Field | Description |

|---|---|

| Address 1 | The street address for the client. |

| Address 2 | Any additional address information for the client, for example, a suite number or an office number. |

| Country | The country where the client is located. This information relates to the address. |

| State/Province | The state where the client is located. This information relates to the address. |

| City | The city where the client is located. This information relates to the address. |

| Postal Code | The postal code where the client is located. This information relates to the address. |

You can view or modify the contact information for different client departments in the Client Contacts section.

| Field | Description |

|---|---|

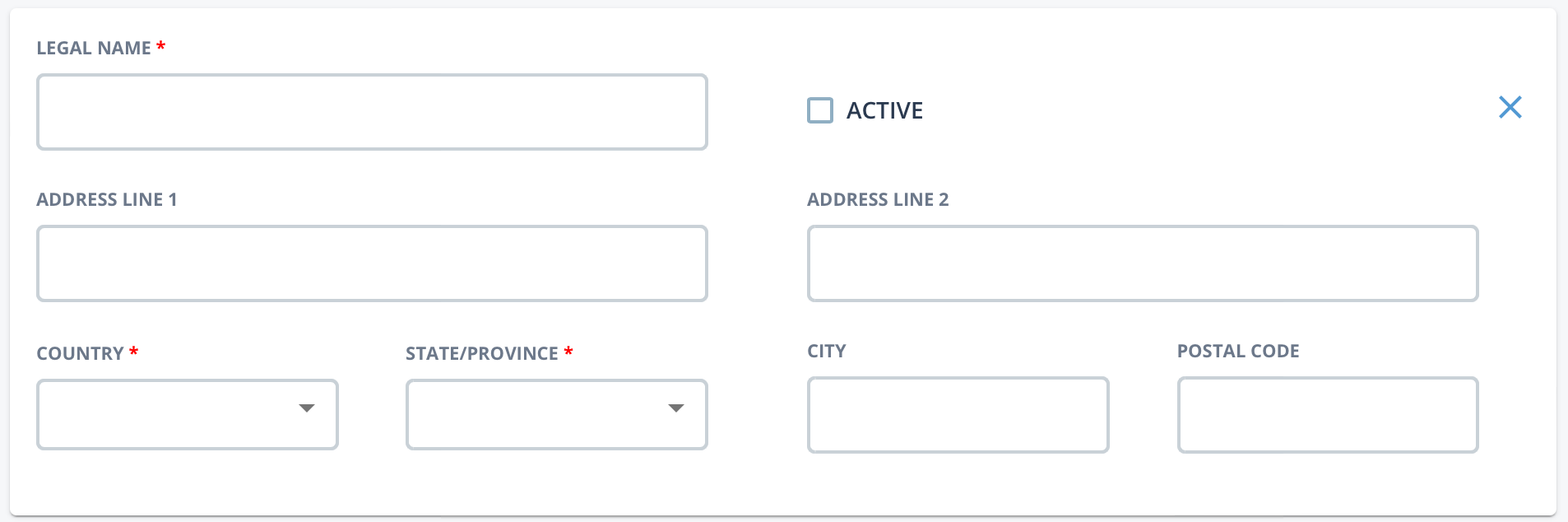

| Legal Entities | Legal entity names are used for invoicing where service taxes

are calculated by the VMS for VAT. To configure a new legal

entity name for a client organization, click

The Country and State/Province fields are used to associate the legal name to defined VAT tax rates defined for a country and state/province. After you configure a legal entity, configure the taxable entity at the client country level. See Tax Rates. VAT tax rates are defined at the MSP

organizational level, but can be edited at the invoice

option level. For more information about these tax rates,

see Tax Rates. Note: When zero tax is calculated, you can display

custom text for the zero tax reason that displays on the

invoice document. Text is customized in the client

country's Instructional Text configuration. See Instructional Text Configuration. |

| Field | Description |

|---|---|

| Contact Type | The type of contact. From the drop-list, select the type of

contact for the contact.

|

| Full Name | The full name (first and last) of the client contact. |

| Phone | The telephone number of the client contact. |

| The email address of the client contact. | |

| Fax | The fax number of the client contact. |

| Address Line 1 | The mailing address for the client contact. |

| Address Line 2 | Additional mailing address information for the client contact. |

| Country | The country of the mailing address. |

| State/Province | The state or province of the mailing address. |

| City | The city of the mailing address. |

| Postal Code | The postal code of the mailing address. |

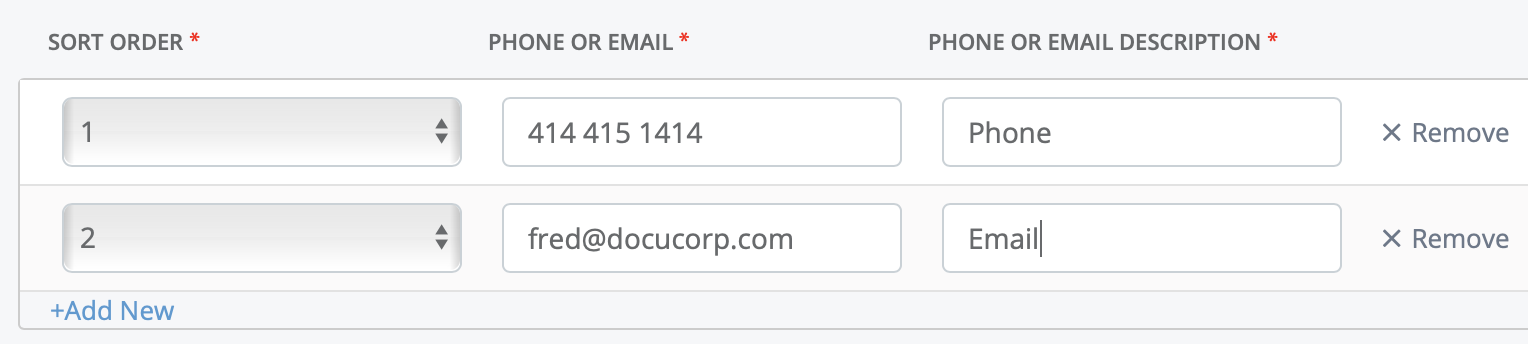

You can modify the contact information that is displayed in the Manager view.

Multiple contact information can be added to this section. To add more than one

line, click ![]() , and then under the Sort Order

drop down, click

, and then under the Sort Order

drop down, click ![]() .

.

The sort order number is used for the display order. You can up to 99 contact lines.

| Field | Description |

|---|---|

| Contact Description | The title of the contact. |

| Address 1 | The address business title or address of the business. |

| Address 2 | Additional address information for the MSP contact. |

| Country | The country of the address. |

| State/Region | The state or province of the address. |

| City | The city of the address. |

| Postal Code | The postal code of the address. |

| Sort Order | The order to display the contact line information. Note: You have

to configure at least one contact line and then save in order to

add a second, third, and so on. |

| Phone or Email | The phone number or email address for the contact line. |

| Phone or Email Description | The description of the contact line information (cell phone, desk phone, email, and so on). |

Currency Conversions

- Request/Engagement Approvals - If the approval workflow () has the Display all cost Amounts in USD setting activated, and the request/engagement is denominated in a currency other than USD, then the amounts are shown in USD for approvals (Approvals tab). The amounts also display in USD in associated approval emails.

- Billing Item Approvals - If the approval workflow () has the Display all cost Amounts in USD setting activated, and the request/engagement is denominated in a currency other than USD, then the billing item amounts are shown in USD for approvals (Approvals tab). The amounts also display in USD in associated approval emails.

Exchange rates should only be updated according to the client organization's business practices.

| Field | Description |

|---|---|

| Currency | From the drop down, select a configured currency. For more information about configuring a currency for the client organization, see Currency Configuration. |

| Exchange Rate (USD) | Enter the exchange rate for the currency to USD. For example, from GBP to USD. |

| Effective Date | Enter the effective date for the exchange rate.You can also click the calendar icon to open a calendar pop up that allows you to select the date. |